There is no minimum required deposit to open an IBKR cash account. However, as our Interactive Brokers review points out, some accounts do have a minimum deposit. Portfolio margin accounts require a deposit of at least $100,000. However, before you log in to the Interactive Brokers platform, review not only its prices but its services.

Interactive Brokers vs. Webull 2023 – Investopedia

Interactive Brokers vs. Webull 2023.

Posted: Mon, 17 Oct 2022 19:17:13 GMT [source]

It should be noted that just a handful of brokers are regulated in the USA, giving Americans an opportunity to trade forex and CFDs. Our forex comparisons and broker reviews are reader supported and we may receive payment when you click on a link to a partner site. See how Interactive Brokers compares to the leading Forex brokers by reading one of the reviews below.

Fees

Interactive Brokers Group is a financial service provider with a broad organizational structure. The broker has subsidiaries and affiliates in different international regions, while the company is headquartered in the United States. Interactive Brokers has different trading accounts to suit each client’s unique needs and help them grow in their trading journey. These accounts are classified as; Individual, Professional, and Corporate accounts. Being in the financial market for more than 45 years, Interactive Brokers has earned a comfortable position as one of the most popular and reliable online platforms globally. The company was founded in 1978 and is headquartered in the United States, with other offices in Canada, Europe, Japan, Ireland, Singapore, Hong Kong, India, Australia, and the United Kingdom.

- There are several quality online brokerages, and each of them has its merits, drawbacks and advantages that speak to you specifically.

- Below is a short summary of the trading accounts of the company.

- The platform is fast and includes standard features such as real-time monitoring, alerts, watchlists and a customizable account dashboard.

- Also, you will need to choose base currency of the account in this section.

- Our guide to the Best Forex Brokers for 2023 is a great resource for traders who are looking for a forex broker, and our Beginner’s Guide is a great starting point for newer, less experienced forex traders.

WebTrader, as we mentioned earlier, is only available if you plan to sign up for the IBKR Pro plan. This portal is designed to offer a simpler, more intuitive interface. It is HTML-based with traditional web tabs and a customization feature, so you can arrange your desktop view just the way you like it, down to font types, sizes, colors, and more.

Trading on margin is only for experienced investors with high risk tolerance. For additional information about rates on margin loans, please see Margin Loan Rates. Security futures involve a high degree of risk and are not suitable for all investors. The amount you may lose may be greater than your initial investment. Before trading security futures, read the Security Futures Risk Disclosure Statement. Structured products and fixed income products such as bonds are complex products that are more risky and are not suitable for all investors.

Interactive Brokers Fees and Plans

This new international trading app allows you to deposit funds in your local currency and trade stocks from your phone or tablet. You can access 90+ global stock exchanges in North America, Europe, and Asia. TWS offers an abundance of functionality and features and is designed for active traders and investors who demand flexibility along with access to multiple products. The customizable TWS provides trading, order management, portfolio management tools, and both fundamental and technical charting. Interactive Brokers For You notifications offer customized alerts about events that could affect a trader’s investments.

- Our Interactive Brokers review reveals what IBKR has (and doesn’t have) to offer.

- Sustainable investors will be happy with the Impact Dashboard and app, which helps you evaluate assets through a socially responsible investing (SRI) lens.

- The retirement-investor set will be happy with the broker’s impressive list of no-transaction-fee mutual funds — over 18,000 in all, above and beyond the vast majority of the broker’s competitors.

- Also, be sure to check out our in-depth reviews of forex brokers – we detail the regulatory status of each individual forex broker across the international forex landscape.

- Interestingly enough, Interactive Brokers (IBKR) has always been more of a trend-setter than an early adopter.

Though forex is not its main focus, the Traders’ Insight daily video update is produced by IBKR’s Chief Strategist, which I found to be a great quality. The following table summarizes the different investment products available to Interactive Brokers clients. Active investors looking to trade a range of products with low brokerage should consider IBKR.

Does Interactive Brokers have margin trading?

There’s a stock scanner on Client Portal, but it’s not as powerful as the one on TWS. This is a professional-level tool that is completely customizable. Similarly, you have access to real-time streaming data, charting, drawing tools, research, and https://forex-reviews.org/lexatrade/ news on all the platforms. News is available from dozens of sources, including Benzinga, Dow Jones, Morningstar, Seeking Alpha, Thomson Reuters, Refinitiv, and in-house commentary. Premium news subscriptions are also accessible for a monthly fee.

Important factors to consider when gauging the size of a forex broker are the assets under management, number of clients, and market capitalization (valuation for public companies). This is especially important given the risks involved in trading forex from a margin account. Forex brokers typically offer a range of contract sizes so you can fine-tune the size of your trade – which will determine how much risk you are taking for a given profit target.

Interactive Brokers offers futures contracts for the entire U.S. stock markets, as well as international options. You’ll pay just $0.25 to $0.85, depending on your account type and your purchase volume. Interactive Brokers even offers the ability to buy fractional shares of stock and was also the 1st major broker to offer this feature. It can help you access world markets and make quick decisions with a simple interface.

Education at Interactive Brokers

In most countries, you need to be 18 or older to open a Cash account, and 21 or older to be able to trade on margin. It usually takes about two or three working days for Interactive Brokers to approve your account once you have completed the online application form and submitted all required documents. When you use cash account, you’re not allowed to borrow from the broker, ie. Cash account limits the potential losses, you can’t lose more than the originally invested amount. Yes, Interactive Brokers is free, if you are from the US and use IBKR Lite.

What is a Broker Fee? – Benzinga

What is a Broker Fee?.

Posted: Mon, 26 Jun 2023 21:02:00 GMT [source]

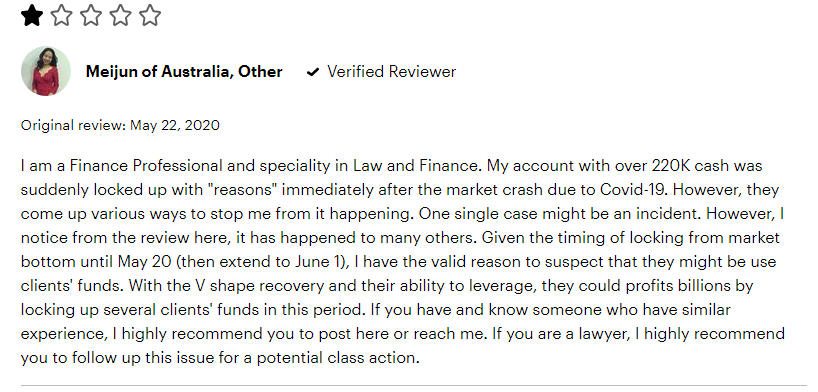

In accordance with its regulatory obligations, IBKR may conduct additional due diligence on client deposits, particularly deposits from anyone other than the account holder. Please refer to the communication sent to you on June 12, 2023, regarding the outcome of the compliance review. We would appreciate the opportunity to turn around your experience.

As of April 2023, the following banks held deposits from IBKR (this list is subject to change over time at IBKR’s discretion). Certain banks, which are affiliates or branches of foreign financial institutions, are subject to regulatory oversight by the Federal Reserve and the Office of the Comptroller of the Currency. Its traders can contact Interactive Brokers through its customer service team, available in physical offices, on the broker’s website, social media platforms, live chat, email, and phone. The broker also offers support in multiple languages, including Spanish, French, English, Chinese, Russian, German, Italian, and Japanese.

If you trade option spreads, IBKR Pro’s Smart Routing is very beneficial for you as this order type submits each leg at the best possible venue for execution. You pay options fees depending on the number of contracts you traded in any given month. Interactive Brokers charges a volume-based commission with a minimum amount. Margin rates vary based on the amount and the currency of the borrowed money. To have a clear overview of Interactive Brokers, let’s start with the trading fees.

The TWS Market Scanners let you scan global markets for the top instruments (including stocks, ETFs, options, futures, bonds, and indexes) based on the parameters and filtering criteria you define. It’s possible to transmit orders directly from a scanner and save a scan as a template to use again. The Fundamentals Explorer (on both TWS and Client Portal) dives deep into hundreds of data points covering historical trends, industry comparisons, key ratios, forecasts, ratings, ownership, and more.

The tool offers a portfolio checkup, including total returns, risk measures, and allocations by geography, asset class, and sector. Socially conscious investors can view their portfolio’s ESG ratings. The tool is free, even if you don’t have an IBKR account, but only customers can access advanced features and real-time updates.